Lending Intelligence, Integrated Seamlessly.

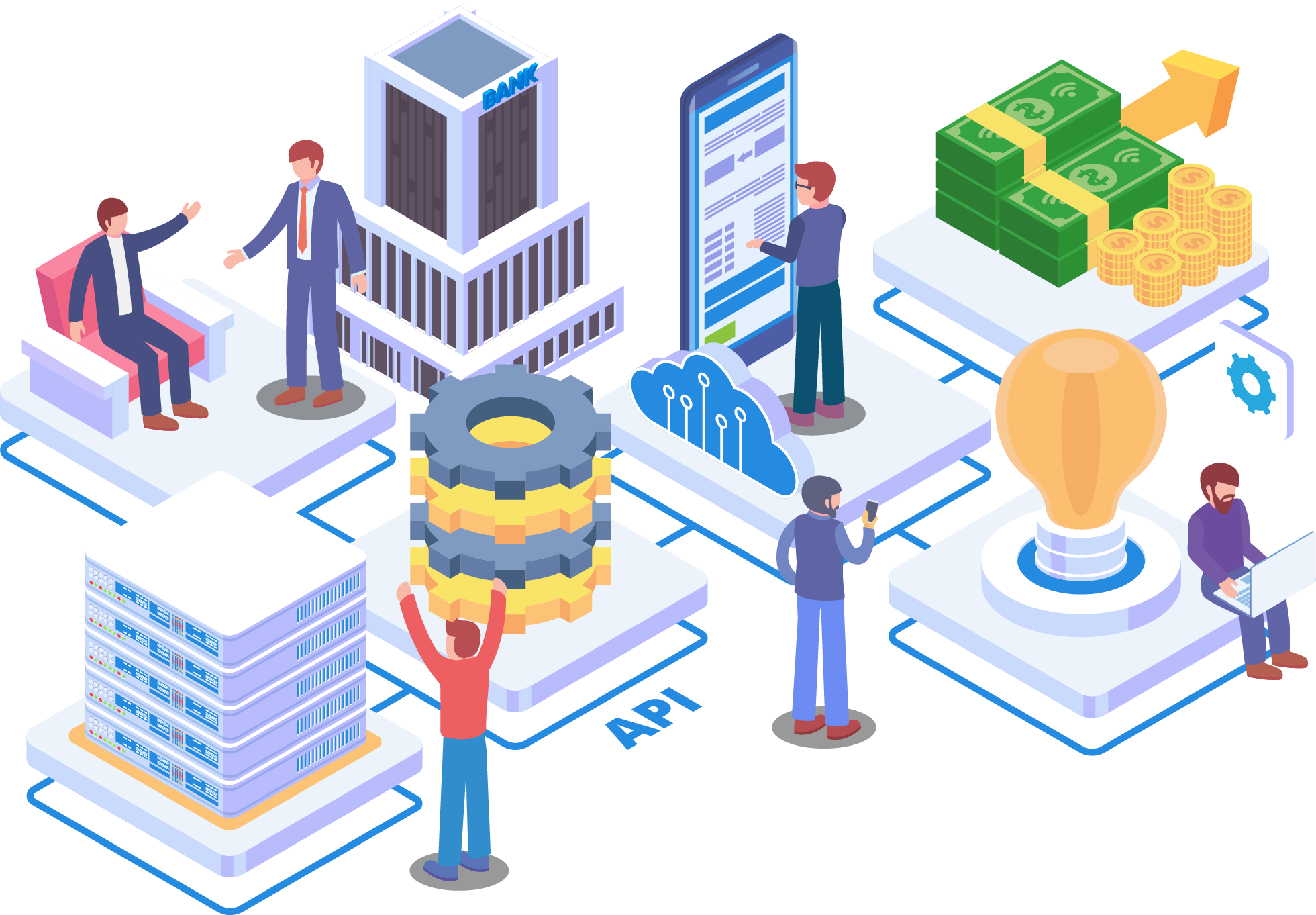

Your lending business runs on connections — to data, payments, verification, and customer communications. OmniaCnct is the powerful platform built to simplify and centralize those connections, offering seamless API access, smart payment routing, and secure token management. Everything you need to scale and streamline your digital lending operations starts here.

Software Suite Overview

OmniaPay

OmniaPay is an integrated payment processing platform designed to streamline loan payment collections and simplify compliance for lenders through flexible, automated options.

OmniaVerify

OmniaVerify is a real-time identity and bank account verification tool to help lenders reduce fraud, ensure secure, accurate borrower data, and streamline loan processing before funding.

OmniaText

OmniaText is an SMS platform that lets lenders automate and manage borrower text messaging for reminders, updates, and two-way conversations within their loan management system.

OmniaCnct Key Features

Central API hub for payment, verification, and messaging systems.

Secure tokenization vault to protect sensitive customer data.

Smart payment routing engine to optimize transaction speed and cost.

Pre-built payment gateway connections via iFrame for easy setup.

User-friendly Smart Payments UI for simplified management and monitoring.

How It Works

OmniaCnct acts as the command center for your financial tools. Connecting your verification, payments, and customer engagement solutions into one cohesive platform reduces complexity and strengthens security — while giving you full control over your customer experience.

Why It Matters

-

Accelerate integration timelines.

-

Strengthen security and compliance.

-

Centralize control over transaction flows.

Why Choose OmniaCnct?

-

Purpose-built for modern lenders.

-

Scalable and future-ready platform architecture.

-

Reduces development costs and vendor management.

-

Streamlined tokenization and data protection.

-

Optimized for real-time operational efficiency.

Request More Info. Today!

Simplify your tech stack and future-proof your lending operation.